Online gambling has become one of the world’s most lucrative industries. Predictions say that by 2024 the revenues from this business will rise to a whopping $94.4 billion. Such a large money flow is opening a lot of opportunities for criminal activity, so anti-money laundering (AML) measures are forced on all operators and gaming institutions.

A combination of factors is contributing to this growth. One key reason is that our world is becoming increasingly more digitized every day. Mobile devices and other advanced technology provide players with a plethora of experiences that simulate real-world experiences all while introducing convenience, variety, and low-cost options that are now accessible from the palm of your hands.

Almost 4.4 billion people globally are active internet players as of April 2019. This means that nearly 60% of the human population has the means to connect and interact with the online world around them.

It’s no surprise that these combined factors have fueled the market for online gambling and gaming. In an already heavily regulated marketplace, this rapid growth is bringing Know Your Player (KYP) and Anti-Money Laundering (AML) to the forefront of regulators’ agendas around the world.

With a wide range of options for players to gamble online, it makes sense that the iGaming companies that will come out on top are going to strike a balance between compliance and player experience. The question is, how can iGaming companies maintain compliance without sacrificing an incredible online gaming experience for their players?

Therefore, iGaming operators have to meet international and local AML obligations. AML regulations for the online gaming industry vary from country to country. In this article, we will examine general AML regulations covering the iGaming sector, online gaming platforms, and gambling industries.

Risk-Based Approach in The iGaming Industry #

As in every industry, a risk-based approach is very important and necessary in the online gaming industry. In order for an AML control program to achieve its purpose, it is very important to identify risks and take precautions against risks.

As part of the risk-based approach, iGaming operators must implement risk assessment by implementing AML controls to new players throughout the player engagement process. Know Your Player/Customer and Customer Due Diligence procedures describe the controls that must be implemented during the player onboarding process.

Latest iGaming Developers

Fundamental AML Requirements for Online Casinos #

iGaming operators must comply with laws and regulations aimed at preventing money laundering and terrorist financing (ML/FT). Compliance is particularly important for online casinos websites due to the high-risk nature of their business.

Well-adjusted AML compliance programs. Online casinos platforms must develop their own compliance program, defining how they detect, analyze, and report criminal incidents such as money laundering and fraud attempts. There is no one-size-fits-all compliance regime, so each online casino must develop one in accordance with the specifics of their business.

Due diligence measures. Before an individual is permitted to gamble, online casinos operators must verify them, evaluating the dangers they pose in terms of ML/FT. The format of these due diligence measures varies from country to country. Some regulators require biometric checks of online gamblers, as is done in the UK. Whereas in Germany, video identification is sometimes required.

There are two common levels of due diligence.

- Customer Due Diligence (CDD) involves gathering basic information about the player (such as their name, address, and date of birth) and verifying it through a reliable source. Online casinos also have to check players (or “gamblers”) against databases containing PEPs, sanctioned and blacklisted individuals, as well as adverse media.

- Enhanced Due Diligence (EDD) is a more sophisticated protection layer which follows CDD in the event that a player poses a high risk of money laundering. Online casinos websites, however, are almost always required to perform EDD given the high ML risk associated with the sector. EDD includes verification of source of funds (SoF) documents, which include debit/credit cards, bank statements, savings accounts, recent paychecks, etc. The types of accepted source of funds documents can vary from casino to casino.

Latest Insights

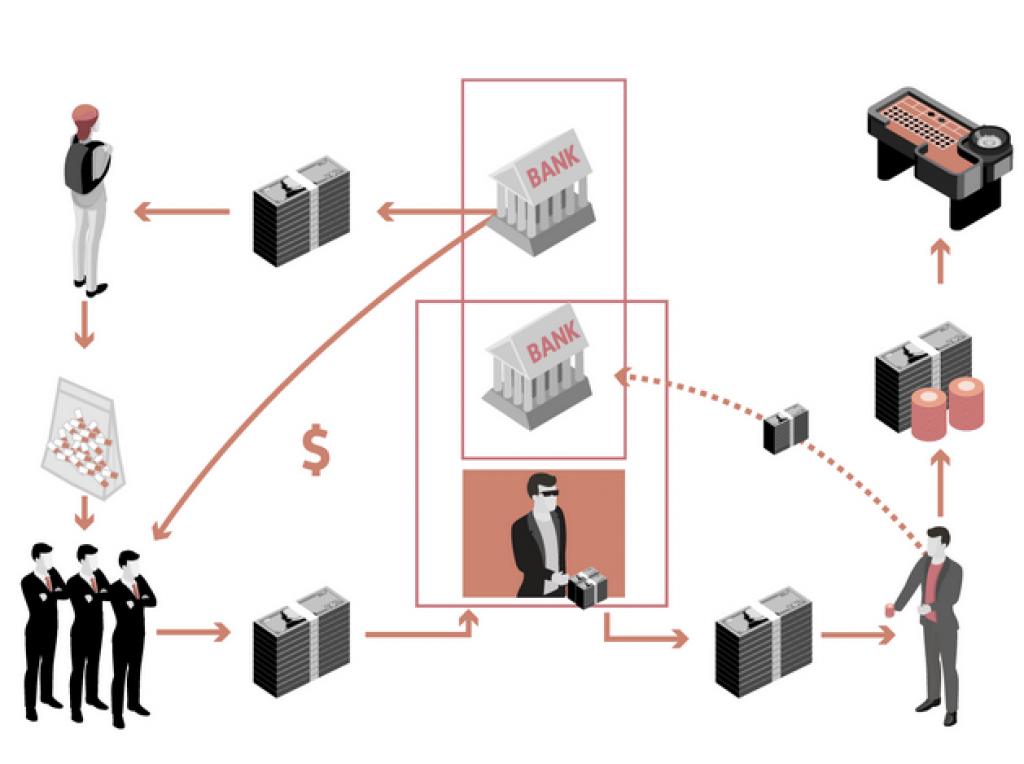

How Can Someone “Wash Money” in Online Casinos? #

Actively evolving technologies are enhancing iGaming opportunities, making online casino games easily accessible in many global markets. This is why new online venues are popping out like mushrooms after the rain. It doesn’t help that some jurisdictions have loose regulations and enable quite simple procedures for opening an iGaming hub.

With so many new venues, the amounts of money that are circulating in the sector increases significantly. And that lures individuals and organizations with a need to “launder” the money obtained from certain criminal activities.

Activities such as:

- Drug trafficking

- Smuggling

- Illegal arms trade

- Prostitution, etc.

Money obtained from such criminal activities is “invisible” to the government. If it simply appears on the personal or company’s account, it will alert the authorities who will then investigate its origin. To avoid detection, this money has to be “washed” and then inserted into legal money flows. And online casinos websites are a slippery slope, favorable for these actions.

Latest Reviews

Responsibilities of the iGaming Operators in the Implementation of Effective Know Your Player (KYP) #

Online gaming companies and iGaming operators in the online gambling and iGaming industries are legally obligated to verify player identity, age, location, and source of funds among other categories in order to protect their players and online gaming platform from bad actors and fraud.

Just as reputable iGaming companies prioritize trust when it comes to providing players with fair play and a secure environment, players must be able to trust that information being collected from them is being handled appropriately and safeguarded.

iGaming operators and companies looking to stay both in compliance and competitive are seeking advanced onboarding & identity verification solutions to…

- Protect the online gaming platform and players from bad actors and fraud

- Continuously comply with the latest global regulations

- Deliver a seamless, trustworthy, and user-friendly experience

Know Your Player (KYP) Compliance Framework for Online Gaming Platforms #

In its simplest terms, KYP means being able to tell the difference between favourable and unfavourable players. Specifically, “unfavourable” means anyone with political or criminal connections, or with a history that otherwise deems them to be high risk for your iGaming platform.

Sourcing high-quality KYP information has historically been a tedious, difficult and unreliable task.

Even so, financial institutions around the world have been required to do this for over the last few decades. After all, lending money to or servicing a person who presents a high risk of default, or who may be involved in illegal activities, can be incredibly damaging for any bank or financial institution.

Many other industries are only now facing the reality of international business and introducing measures to ensure widespread KYP compliance. Unfortunately, this is an entirely new activity for many organisations, leaving them unsure of how to acquire, collate and analyse the right information.

It will be your responsibility to prove its KYP compliance and that everyone involved has done their part. This involves documenting and keeping relevant records on all players, including their background, the nature and size of their transactions, as well as the source of their funds and the reason of the existing transaction relationship. Failure to do so brings with it significant risk in terms of financial cost, reputational damage and potential judiciary consequences.

At a minimum, organisations are generally required to document players’ financial background, their source of funds and wealth, the purpose of specific transactions, and the expected nature and level of transactions.

There are four primary objectives when gathering KYP information, using a risk-based approach:

- Identify the player

- Verify the player’s true identity

- Understand the player’s activities and source of funding

- Monitor the player’s gaming activities

While there are a number of high-quality free sources of information, such as search engines or public databases, finding exactly what you need from this vast range of resources is incredibly time-consuming. This simply isn’t a feasible long-term approach for any business that values speed, efficiency and scalability. It’s also absolutely essential that all sources are verifiable and trustworthy.

Latest Events

Anti-Money Laundering (AML) Principles for iGaming Sector #

Anti-money laundering (AML) is a blanket term for the constantly evolving laws and regulations that are in place to prevent money laundering and other related financial crimes. AML compliance is a lot more comprehensive and actually includes KYP compliance as one of its requirements.

AML legislation in Europe is currently defined by the 4th Anti-Money Laundering Directive (4AMLD), which covers everything from KYP requirements and virtual currencies to internal company policies that specifically address money laundering and terrorist financing.

The upcoming 5th AML Directive was successfully voted on in April 2018 and will be rolled out across member states within the next 18 months. The 5th Directive will build on the requirements of the 4th, but with a stronger focus on a few specific activities linked to virtual currencies and other new technologies. Below are some quick tips for AML compliance:

Stay informed supervisory outcomes in the iGaming plaform #

As AML legislation and regulations are always evolving, it’s vital to be aware of new developments and ensure they’re understood and followed across your iGaming operation. Always be on the lookout for new developments and for great information resources.

Build a responsible culture in iGaming Business #

As AML compliance requires policies and processes that are applied consistently across the iGaming operation, it’s important to have a culture of ethical practice that’s communicated from the top down. Regular training for all people in the iGaming business with strong involvement of the Top Management, including Board Members, is essential.

Assess and quantify risks more broadly #

Take a more comprehensive approach to risk assessment and quantification based on your jurisdiction, the country of residence of your players, but also the technical features of your online gaming products or services. Your risk based-approach, the generally named Risk Matrix, should take into account your policy towards affiliate businesses and partnerships.

Exposure to risk needs to account for these third parties, their respective connections, as well as their iGaming products. It is also a good idea to tailor risk assessment for each unique jurisdiction, as well as to proactively gauge the inherent risk of existing and future regulations in the considered jurisdiction.

Does this affect my iGaming operation? The short answer is: yes. Even if your online gaming industry has not traditionally required it, widespread KYP and AML compliance is quickly becoming the norm on the international business stage.

What’s next? #

KYP and AML compliance isn’t going anywhere, in fact, it’s getting more and more crucial for companies to integrate technology in order to stay ahead of the game.

Based on what we observe, iGaming operators shouldn’t expect regulations to loosen in the near future. On the contrary, more countries are seeking to develop a regulated iGaming industry, with an aim to protect vulnerable nationals from problem gambling. So, the best move would be to stay on top of these shifting demands and be ready for whatever comes next.

As technology advances the schemes become more complex and sophisticated. Add to that usage of virtual credit cards, prepaid mobile credit, and alternative payment gateways like PayPal, and detection of the money laundry becomes much harder.

On the brighter note online gaming operators are quite aware of this fact. Fines for not following regulations measures in millions, so it’s in their best interest to impose strict procedures. More rigorous KYP checks lead to a better following of the anti-money laundry rules, making online gaming websites safer for both players and iGaming operators.